Iran’s steel sector to see tectonic shifts as new currency rules take shape

After weeks of uncertainty and the lack of details, the Iranian steel industry finaly saw some clarity about the functioning of the secondary exchange market set up by the Central Bank of lran (CBI)to enable exporters of non-oll products to slltheir foreign currency earnings to importers of consumer goods. Market participants emphasise that the move will be a game-changer for international trade.

The Ministry of Industry, Mine and Trade and the CBl agreed on the principles of work within the secondary exchange market to faicilitate the access of domestic industries, including the steel sector, to foreign currency resources and control market fluctuations. Under the agreement,

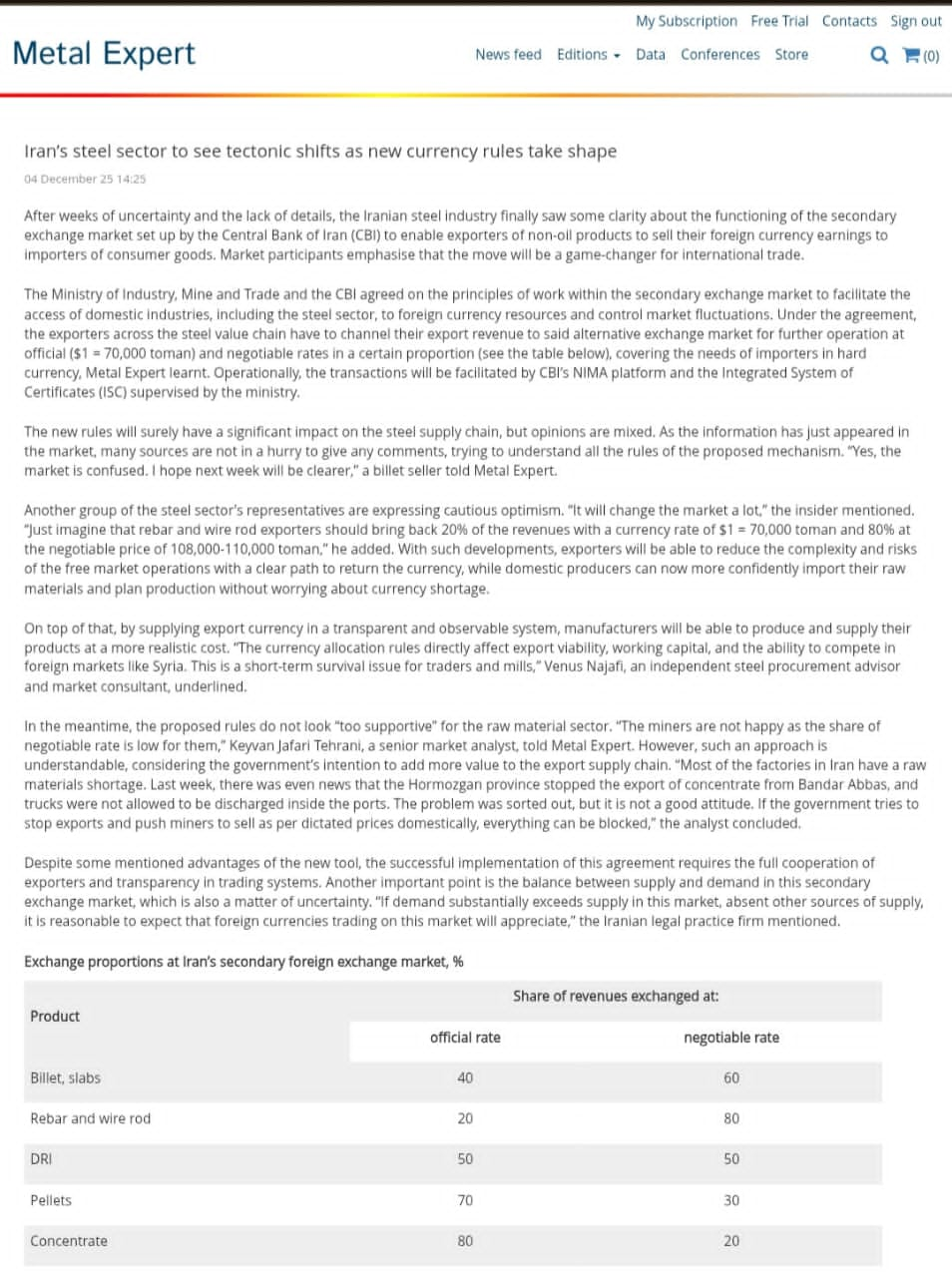

the exporters across the steel value chain have to channel their export revenue to said alternative exchange market for further operation at official ($1 70,000 toman) and negotiable rates in a certain proportion (see the table below), covering the needs of importers in hard a currency, Metal Expert Iearnt. Operationally, the transactions willbe facilitated by CBIs NIMA platform and the Integrated System of Certificates (ISC) supervised by the ministry.

The new rules will urely have a significant impact on the steel supply chain, but opinions are mixed. As the information has just appeared in the market, many sources are not in a hurry to give any comments, trying to understand all the rules of the proposed mechanism. “Yes, the market is confused. I hope next week will be clearer,'” a billet seller told Metal Expert.

Another group of the steel sector’s representatives are expressing cautious optimism. “It will change the market a lot,’ the insider mentioned,.

“Just imagine that rebar and wire rod exporters should bring back 20% of the revenues with a currency rate of $1 70,000 toman and 80% at a the negotiable price of 108,000-110,000 toman, he added. With such developments, exporters will’be able to reduce the complexity and risks of the free market operations with clear Path to return the currency, while domestic producers can nowmore confidently import their raw materials and plan production without worrying about currency shortage.

On top of that, by supplying export currency in a transparent and observable system, manufacturers will be able to produce and supply their products at a more realistic cost. “The currency allocation rules directly affect export viability, working capital, and the ability to compete in foreign markets like Syria, This is a short-term survival issue for traders and mills, Venus Najaf, an independent steel procurement advisor and market consultant, underlined.

In the meantime, the proposed rules do not look “too supportive” for the raw material sector. The miners are not happy as the share of negotiable rate is low for them,” Keyvan Jafari Tehrani, a senior market analyst, told Metal Expert. However, such an approach is understandable, considering the governments intention to add more value to the export supply chain. “Most of the factories in Iran have a raw materials shortage. Last week, there was even news that the Hormozgan province stopped the export of concentrate from Bandar Abbas, and trucks were not allowed to be discharged inside the ports. The problem was sorted out, but it is not a good attude. If the government tries to stop exports and push miners to sell as per dictated prices domestically, everything can be blocked,”‘the analyst concluded.

Despite some mentioned advantages of the new tool, the successful implementation of this agreement requires the full cooperation of exporters and transparency in trading systems. Another important point is the balance between supply and demand in this secondary exchange market, which is also a matter of uncertainty. “If demand substantially exceeds supply in this market, absent other sources of supply, it is reasonable to expect that foreign currencies trading on this market will appreciate,”the Iranian legal practice firm mentioned.

Source: metalexpert