HBI is Better Option than DRI to Consume by Iranian Steel Manufactures, said Mr. Keyvan Jafari Tehrani, CEO at Jame Tejarat Co. (JTC). Following are the excerpts from SteelMint interview with Mr. Tehrani.

1- How do you see the current market situation of Iranian DRI Market?

Iran is second largest producer of DRI after India, Major steel producers of Iran has produced 17,406,706 MT of DRI in the 11 months of current Persian year (21 Mar’17-19 Feb’18) as per the data released by IMIDRO.

In Mar’17, Iran ranked as largest producer of DRI which could have passed India. But after the second quarter India took back the position and Iran become second producer of DRI. Right now besides supplying to the local market Iran also export DRI to foreign countries.

As per the data released by ISPA, Iran has exported 586,711 MT during the first 10 months of current Persian year (21 Mar’17-20 Jan’18). Iran has capacity to export 1 MnT in CY’18.

2- Who are the Major DRI producers in Iran in terms of production and capacity?

The largest producer of DRI in Iran is Mobarekah Steel, which has produced around 6,694,575 MT during the 11 months of current Persian year. Followed by Khuzestan Steel (3,708,940 MT), Hormozgan Steel (1,437,621 MT) and South Kaveh Steel (1,437,921 MT).

Recently few new mills has been commissioned in Mianeh and Neyriz region of Iran. During the last year CY’17, few medium sized mills up to the capacity of 800,000 MT were commissioned in different part of Iran. All of them is equipped with Persian reduction technology, only MSC, SKS and KSC has Midrex technology.

3- What is the role of DRI in Iran’s Steel Plan of 2025?

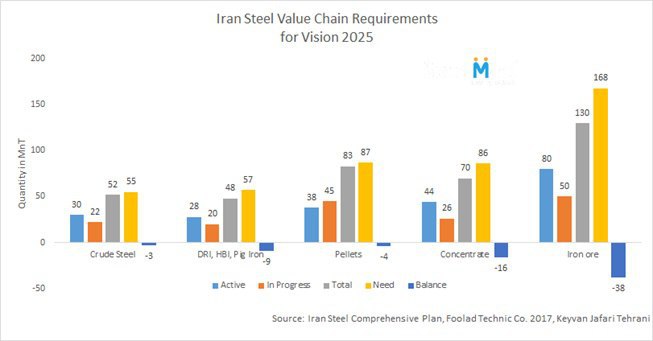

DRI plays an important role in vision 2025 of Iran crude steel production to produce 55 MnT of crude steel annually. Currently Iran hold the production capacity of 28 MnT of DRI and 20 MnT production capacity is under progress. By the end of 2025, Iran will have a production capacity of 48 MnT of DRI production capacity which is still short by 9 MnT. As for vision 2025, Iran needs 57 MnT of DRI production to support crude steel production of 55 MnT.

4- What is the current domestic and export price of DRI in Iran?

Currently the domestic price of DRI is IRR 11,800,000/MT ex work. Whereas export price is hovering at around USD 290-295/MT.

For export, recently SKS had floated a tender of 10,000 MT. The highest bid SKS received was USD 290/MT FOB Bandar Abbas for Feb-end-early Mar delivery. However the business was not awarded by SKS as they expected USD 295/MT FOB Bandar Abbas.

Due to US import tariff the scrap price has increased because most of scrap supplied to Turkey is from US and after the tariff most of it will be consumed domestically by US and supply to Turkey will reduced.

Price of Iran DRI is corresponding and according to price of scrap metal CFR Turkey. The FOB price of Iran DRI is based out of CFR price of Turkey. It is based upon the ratio, on which there is difference in opinion, some says that Iran DRI FOB price is 81% of scrap price CFR Turkey whereas other says that it is 85% of CFR Turkey.

About the exact ratio to calculate to the price of Iranian DRI FOB basis still it is unavailable. But I believe the exact figure should be in between 82-84% of scrap price CFR Turkey. E.g. if the scrap price of Turkey is USD 360 CFR Turkey then the Iranian DRI price comes to near about USD 295-302 FOB Iran. But it depends on specification of cargo and quality of goods. E.g. when Fe total is above 88%, Fe metal is above 82% and metallization is above 94% obviously the price will be higher than the product having Fe metal as 80%, SKS had the Fe metal as 79% for above mentioned export tender.

Price of DRI is according to quality of cargo and most importantly it depends on Fe metal percentage. The correct Fe metal of DRI should be between 82-84% and this is best quality available. And least quality available is 80-82% which price is obviously lower and as the quality goes lower price also gets low proportionally.

5 – DRI will be traded soon at IME, how will it impact domestic and export market?

This is an important thing, AS DRI will be traded at IME the price come over there will clarify the correct price of DRI in domestic market and export market. But the most important thing I am concerned is that as you already know that for pellet and concentrate there is a formula to calculate from the billet price of KSC.

As stated earlier that the price of DRI FOB Iran has be calculated from scrap metal price but not from billet price. Both scrap and DRI is consumed as intermediate raw material to produce billet.

And the price of scrap and DRI expect to increase much more than billet. Billet price has to be fixed or adjust as per the supply and demand of scrap and DRI. For DRI also the formula should be same, i.e. if the supply of scrap is short than the price of DRI should increase and this is something beyond the formula which IME or anybody try to find as index according to billet price. Which I don’t think it is workable mainly for export price of DRI in Iran. But domestic price it may be workable.

As I mentioned that domestic DRI price of Iran is IRR 11,800,000/MT ex work currently which increased due to higher demand of DRI in local market. About 1 or 2 month ago the price was 10-15% lower. But generally this is a good idea if they trade at IME as it will give the correct price.

6 – Recently Persian Gulf Saba Steel inaugurated its HBI plant- how you foresee the development of HBI market in Iran.

HBI is much better than DRI as there is no risk of hazardous or risk in transportation of cargo. I believe as much as possible HBI based steel plant should be commissioned in Iran due to low transportation risk as compare to DRI. And it is a good opportunity for steel plant to consume HBI as intermediate raw material. The price of HBI depending on quality, is USD 5-10 more than DRI according to market level.

Considering the transportation of DRI in bulk, the vessel needs to be specially equipped with Nitrogen gas facility. It is used to fill holds and hatch of the vessel. After each loading the holds and hatch is filled with nitrogen gas to avoid the contact of cargo with oxygen in order to save it from burning.

No ready vessel containing this facility which is equipped with nitrogen pipeline is available at the port. And it takes 20-30 days to bring any vessel to the port and equipping this facility in vessel is very costly.

It can be also transported by using jumbo bag, where there is no need to use nitrogen gas but need to use double liner PP (Poly Propylene) jumbo bags and it is tied tightly to avoid any contact with oxygen when shipping it in container. It brings extra cost for this special packing material.

For HBI no such cost is involved, which is the reason Iran is focusing more on HBI production and it much better domestic and export market. Price on which Iran can sell HBI is higher than DRI not only the USD 5-10 difference on FOB basis but also high cost of equipping the vessel which increase extra cost of USD 25-30 to create such facility.